Open interest refers to total outstanding contracts in futures and options combined across all expiries and across all derivatives in stock market . Increase in open interest means traders are taking fresh new positions in market assuming price will go in direction of stock price movement.This can help with how to select stocks for intraday and to find which stocks to buy and sell. Swing traders use this as well

Learn Stock Market online – technical analysis course for traders.

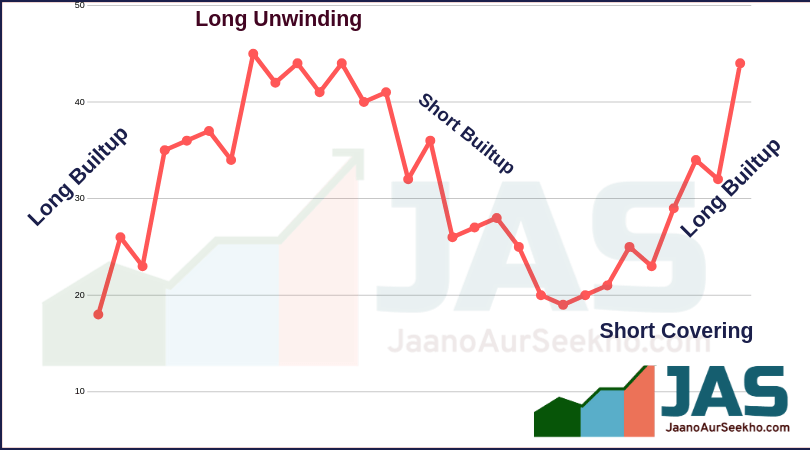

With help of Open interest data from the broker or exchanges, we can see positions that traders are making in futures and options stocks as well as Indexes .The positions are usually classified as Long builtup , Short Builtup , Long Unwinding and Short covering . Lets understand what each of these represent

- LONG Built up : When there is increase in price and increase in Open interest , we say traders are building long positions. It means that people are buying futures or options with anticipation that price will go up .

- Short Built Up : When there is decrease in price and increase in Open interest , we say traders are building Short positions. It means that people are shorting or selling futures or options with anticipation that price will go down. Usually when some stock or index breaks support or reverses from a resistance , we see shorts being built up.

- Long unwinding : When Share prices decrease and Open interest decrease as well , we say that longs are getting unwinded. This shows Long positions are now getting exhausted and people are starting to book profits , assuming rally is about to over

- Short covering : When price increases and Open interest decreases , we say that Short covering is happening . In Short covering , the earlier built Short positions are getting decreased and people are booking profits and expecting reversal.

Combined with volumes , this can serve as important indicator in selecting stocks for intraday or short term